Defensive stocks become hideout for investors in a rocky market

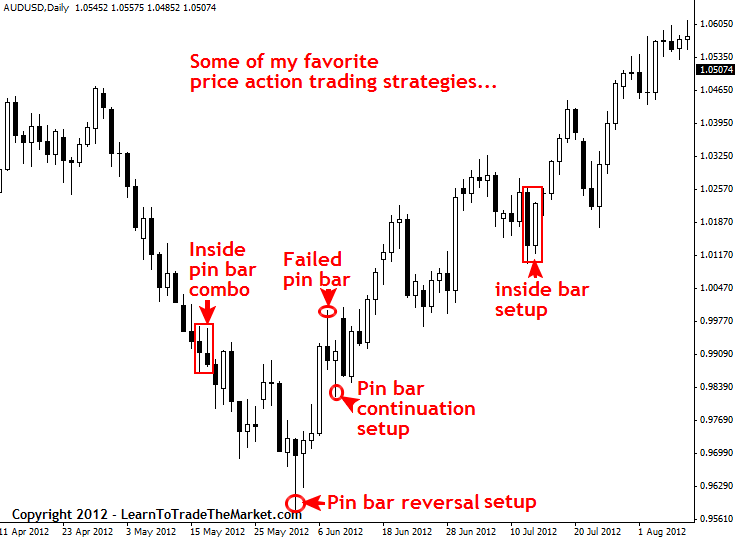

The price has formed a back-to-back Doji candlesticks at the top and thereafter it has started correcting. In the short term, the price is expected to test its recent swing low. The markets are selling off globally and to that point, India is facing a little bit of pressure. However, we continue to trade above the long-term average of 17 times multiple in the Indian markets and there is a possibility that we could drift down towards those levels and 16,800 to 16,900 levels is where the market might find support. Additionally, one should be focussing more on domestic themes, d where there is a lot of value in the stocks. Several public sector banks were part of this list despite seeing a stellar run in 2022.

What are defensive sectors in Indian stock market?

Sectors that do not go out of fashion

Due to their stable demand structure, they tend to be less volatile and also manage to protect price and returns during tough times. In the Indian context stocks like Hindustan Unilever, ITC, Marico, Britannia, Havells are all classic examples.

Smallcases provide a diversified portfolio of stocks, reducing the risk of investing in a single stock, and are managed by professionals who have expertise in this field. However, it is important to do your own research and due diligence before investing in any smallcase or stock. Investing in Indian defence sector stocks using smallcase’s readymade portfolios is a convenient and hassle-free way to gain exposure to this sector. Defence stocks in India are considered a safe investment option due to their stable demand, government support, and long-term contracts. The Indian defence industry comprises public and private sector companies involved in manufacturing defence equipment and supplies. The industry is responsible for meeting the country’s military needs and has been playing a crucial role in developing the nation’s economy.

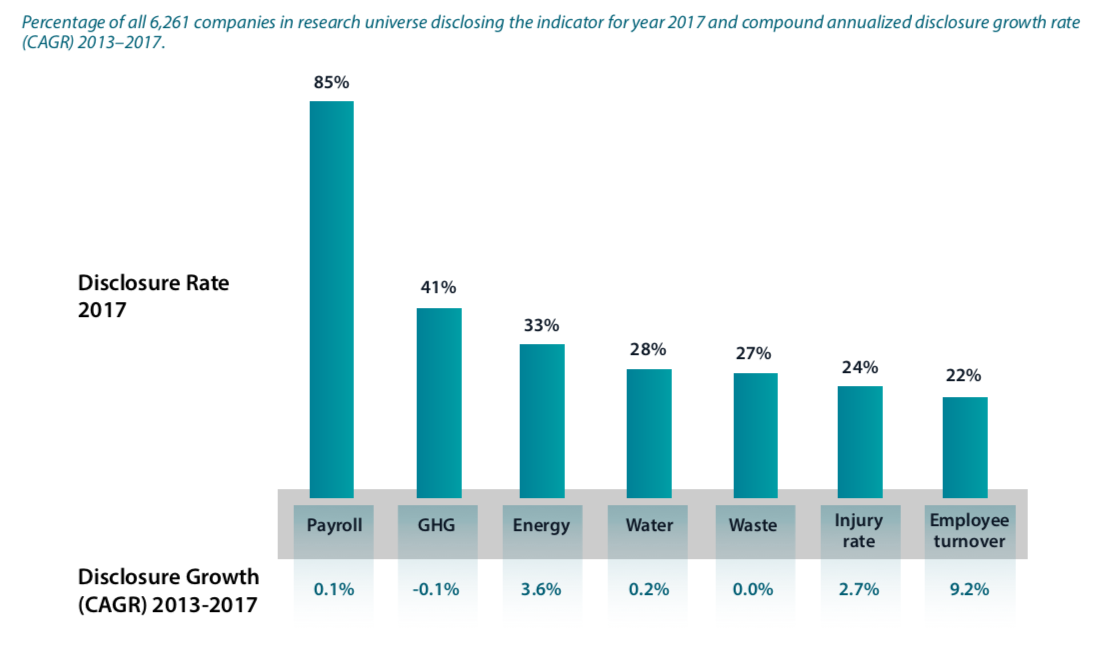

A Step Towards Environmental Friendly Defence Stocks

When you don’t have a proper understanding of risk and market fluctuations, defensive stocks provide consistent returns in the long term. This is another feature of defensive stocks where most companies have relatively undervalued in terms of P/E ratio and P/B ratio. Also, this principle is applicable to sound business models and not every company with low valuations.

Investors tend to invest in the best defensive stocks at the time of an expected fall in the market as this acts as a cushion against volatility. However, active investors switch to high stock beta to maximize returns at times of expected rise in the market. One of the classic conditions of defensive stocks is that they are stocks which still are relatively undervalued in terms of P/E and P/BV. If you take the example of some of the companies like Reliance, IOCL, BPCL, NTPC you will find that most of them are available at fairly compelling valuations. Of course, in most cases the growth potential is limited or the size works against them.

For example, the demand for cement can be postponed but it cannot be done away with. That is why cement stocks have tended to hold value even in the toughest of markets. One can argue that Indian pharma has been going through a harrowing time in the last 3 years but that is for a different set of reasons altogether. It is a case of valuations adjusting to more rational growth expectations. A Defensive Stock is the one that ensures constant returns as the dividends, despite the fluctuations in the entire stock Market.

Get all information related to your transactions directly from the stock exchanges on your mobile phone/email id, at the end of every day. It is a one-time exercise done through a SEBI-registered intermediary . There is no need to repeat the KYC process when you go to any other intermediary. The S&P 500 consumer-staples sector is trading at roughly 21 times projected earnings over the next 12 months, according to FactSet, as of Tuesday’s close.

Factors to Consider Before Investing in Defensive Stocks

You agree not to use the facilities for illegal purposes or for the transmission of material that is unlawful, harassing, libelous , invasive of another's privacy, abusive, threatening, or obscene, or that infringes the rights of others. Go to the smallcase app or website, login in via your phone number and search ‘defence’ keyword and invest in a portfolio that best fits your investment goals. Defence sector shares in India are mainly of two types – the public and private sector companies. The Indian defence industry has made remarkable strides in developing advanced technologies and systems, including missile defence systems, fighter jets, submarines, and unmanned aerial vehicles.

Defensive stocks provide constant dividends and steady earnings to shareholders irrespective of how the market is performing. These companies are called defensive stocks because they showcase consistent demand for their products, making their stock stable during various phases of business cycles. In other words, these stocks belong to industries that produce products with constant demand irrespective of economic conditions. The Indian defence industry is a vital sector of the country’s economy, and the Indian defence sector stocks are essential to the stock market. The industry’s growth prospects are significant due to the government’s focus on promoting indigenous defence manufacturing and reducing import dependency.

WealthDesk enables you to invest in WealthBaskets, which are combinations of equities and ETFs based on an investment idea, theme, or strategy. WealthBaskets are built and closely monitored by SEBI-registered professionals. We believe that there has been a consolidation phase that has been happening in the banking and financial sector and we prefer to opt for the larger banks in defensive stocks in india the sector. And obviously within that the private sector banks the top three or four have been within our radar and then we have had a couple of public sector banks out there. Besides this, Bank Nifty and PSU Bank indices are seen moving inside the weakening quadrant as well. The Nifty Metal, Media, Services Sector, Commodities, and Energy groups are inside the lagging quadrant.

Inc. are among the standouts, each rallying double-digit percentage points in 2022. The company generates 29% of revenues from its nuclear segment, 21% from the space and defence segment and 50% from the clean energy business. In Q2 FY2021, the total order received by the company amounted to Rs. 52,148 crores that includes fresh orders of Rs. 1,561 crores. The export orders fulfilled by the company amounted to a total of $199 million. Trading in leveraged products like options without proper understanding, which could lead to losses. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020.

Sun Pharma Q3 results: Net profit rises 11% to Rs 2,058.8 crore

Stocks belonging to the above-mentioned companies never go out of business. When income levels increase in the economy, the products witness increased demand. A defensive stock, also known as non-cyclical stock, is a type of stock whose price has a very little correlation with the prevalent economic activities. Irrespective of the performance of the economy, the earnings and revenues of the company remain stable. In such a scenario, the stock price of the company also remains stable. You can prefer defensive stocks when looking for dividends from your stock investment.

Moreover, these stocks have the potential to protect the significant downside risk. Some investors say defensive stocks now seem a bit pricey compared with other parts of the markets. Wall Street often uses the ratio of a company’s share price to its earnings as a gauge for whether a stock appears cheap or overpriced.

These stocks help you to protect your investments during times of recession. If you are a very conservative investor whose main priority is safety, then you can choose to invest in defensive stocks. You cannot expect extraordinary returns from defensive stocks as they simply function as safe haven stocks. If you are a newcomer to the market, you can start investing in these stocks in the initial phase as volatility is less and these stocks won’t give you sleepless nights.

These are daily usage items that have a certain cash flow in all economic conditions. So, these stocks outperform during weak economic conditions and underperform during strong economic conditions when compared with cyclical stocks. The market can go up and down depending on the macro and the micro news that flow in the market. This means that a company that is giving a good return today might not give a good return tomorrow. In order to protect ourselves from such volatility, we need to have some defensive stocks in the portfolio.

No fee of whatsoever nature is to be charged for the use of this Website. Defensive stocks offer a high dividend yield, making them very attractive at lower levels due to the annuity income they generate. Also, these companies use retained earnings for business expansion and distribute dividends to shareholders. Some popular companies in India that fall under this category are Coal India, REC, Chennai Petroleum, etc. An investor’s portfolio should have a mix of both cyclical and defensive stocks and only this will help in mitigating risk and reduce loss.

How to find defensive stocks?

Defence sector stocks in India are considered a safe investment option due to their stable demand, government support, and long-term contracts. Investors can consider investing in defence stocks by conducting thorough research and analysing the companies’ financials, growth potential, and market conditions. So as you learn about the defensive stock meaning & example, it's better to make a bucket where you can track all the defensive stock of the share market. As an investor you need to calculate the amount of risk and in the time of crisis use these types of stock as shields to rescission or economic crisis due to various reasons. A proper knowledge in the stock market will always help you to achieve better returns than lost.

Which is best Defence stock in India?

- Data Patterns (India) Ltd.

- Hindustan Aeronautics Ltd (HAL)

- Bharat Dynamics Ltd (BDL)

- High Energy Batteries (India) Ltd.

- Taneja Aerospace and Aviation Ltd.

- Sika Interplant Systems Ltd.

- Paras Defence and Space Technologies Ltd.

Never take any decision based on hearsay as you will end up in losses. Have a proper understanding of the goals, your risk appetite, investment avenues and then buy shares. Continuous monitoring of your portfolio alone will help you in the long run as you should be up to date on how each and every stock is performing in your portfolio.

Best Websites for Indian Traders

Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product. Readers are advised to exercise discretion and should seek independent professional advice prior to making any investment decision in relation to any financial product. Aditya Birla Capital Group is not liable for any decision arising out of the use of this information. Stocks of firms such as FMCG and healthcare belong to the defensive category. This is because even when the economy experiences a downturn, the demand for products of these companies isn’t down.

Just like selecting other stocks, it’s important to adopt due diligence to make an informed choice. Let’s explore more about defence stocks in India and how you can invest in them. Still, Mr. O’Keefe said his portfolio remains overweight in healthcare and consumer-staples stocks, as those companies should continue to perform well in the coming year as the Fed keeps raising rates. Please note that SEBI has restricted us only from acquiring new customers until the matter is resolved. They have given us 21 days to give a comprehensive response to their prima facie findings, and issued an interim order.

- But before investing, any individuals must do due diligence while selecting a stock and make informed investing decisions.

- Using various ratios like dividend yield, P/E, P/B, etc., will help you to understand the stock movement in the short, medium and long term.

- Samco’s Star Ratings Page and check the star ratings of each stock you wish to invest in.

- VRD Nation is India’s premier stock market training institute and we are passionate about teaching each and every aspect of investing and trading.

- FREE Demat account with Samco Securities now and enjoy trading and investment ideas at your fingertips.

- Information on this Website sourced from experts or third party service providers, which may also include reference to any ABCL Affiliate.

The consumer-staples sector’s lead over the S&P 500 is on pace to be the biggest since 2008. Reports appearing in several business papers have alleged that there has been a “default of Rs. 2000 crores” in the headline. Firstly, because if there is a default in our business, as stock broking is not a line of business where the term default is relevant, and the SEBI order itself neither mentions a default nor an amount of Rs 2000 crores. We want to reiterate once again that nowhere in the SEBI order has an amount of Rs 2000 crores been mentioned, and that this number together with the word default is extremely misleading and damaging to our reputation.

Furthermore, as defensive stocks do not consider market fluctuations, they are beneficial for investors looking to safeguard their other investments when the market falls. When the market is bearish, you can not sell your stocks as they may be below the cost price. However, with defensive stocks, you can ensure you will still get the dividend amount irrespective of the market trend. The latter are shares of companies that operate in the defensive sector and manufacture products that are used by the army forces. On the other hand, defensive stocks are those that guarantee a dividend payout and are not affected by the ups and downs in the market. Apart from investors that rely entirely on the increase in the stock price to make money, there is a different breed of investors who believe in value investing.

What are defensive sectors in Indian stock market?

Sectors that do not go out of fashion

Due to their stable demand structure, they tend to be less volatile and also manage to protect price and returns during tough times. In the Indian context stocks like Hindustan Unilever, ITC, Marico, Britannia, Havells are all classic examples.